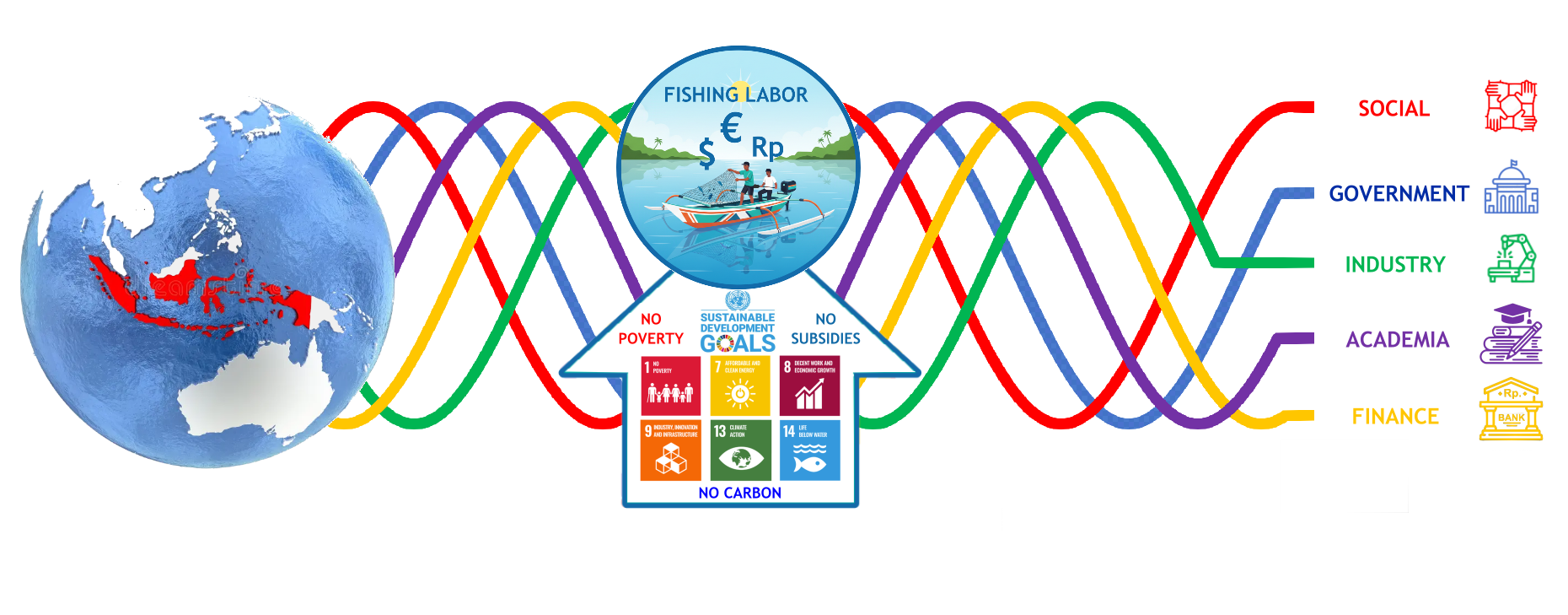

A Symbiotic Framework for

Maritime Decarbonization

& Poverty Alleviation

1. Executive Summary

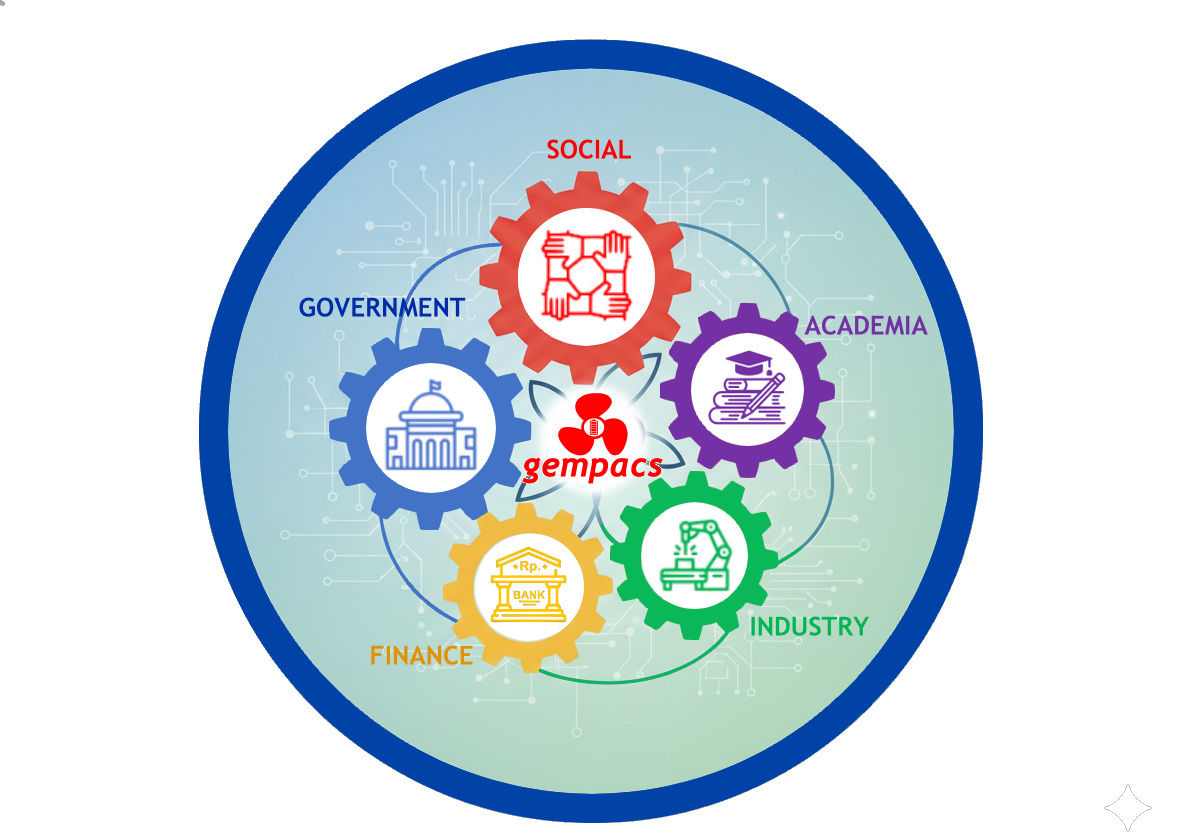

The GEMPACS Quintuple Helix (five helices) represents a paradigm shift in maritime innovation. It moves beyond the traditional “seller-buyer” dynamic to create a self-sustaining ecosystem designed to dismantle the systemic barriers of electrification in developing economies.

Unlike standard models where finance is merely a backend service, this framework elevates The Finance Element to the status of an active Helix, equal in weight to Government and Industry. This structural evolution addresses the critical “High CAPEX / Low OPEX” paradox that has historically trapped small-scale fishers in a cycle of poverty and fossil fuel dependence.

The Core Philosophy:

The entire ecosystem is powered by the kinetic energy of the Social Element (human labor). The primary function of the other four helices is to remove the friction—financial, regulatory, and technical—that impedes this energy, converting efficient labor into decarbonized wealth.

1.1 Theoretical Context: Evolution & The Helix Shape

Why the “Helix”?

The “Helix” metaphor is chosen to reject linear innovation models (e.g., Lab $\to$ Factory $\to$ Market). In a Helix, the strands intertwine, representing recursive interaction. The sectors do not simply hand off tasks; they co-evolve. A change in one strand (e.g., a new Government policy) immediately spirals through the others (altering Finance risk profiles and Social adoption rates), creating a system that is self-reinforcing rather than static.

The Evolutionary Path:

-

- The Triple Helix (Etzkowitz & Leydesdorff): The original model focused on the University-Industry-Government triad. It was designed for the “Knowledge Economy,” creating a synergy where labs created IP, industry commercialized it, and the state regulated it.

- The Quadruple Helix: Scholars later added Civil Society as the fourth strand, recognizing that innovation must be socially relevant and “democratized” to survive.

- The Quintuple Helix (GEMPACS Adaptation): Standard academic models often add the “Environment” as the fifth helix. However, the GEMPACS model adapts this to the reality of developing economies. Here, Finance is elevated to a distinct Helix. Why? Because in this context, capital constraint is a structural barrier as formidable as the laws of physics. This model explicitly integrates Finance to ensure the engine has the fuel (capital) to run.

2. The Five Helices: Deep Dive

Helix 1: The Social Element (The Kinetic Engine)

-

- Entities: Small-scale traditional fishers, Koperasi (Cooperatives), Coastal Communities, and Grassroots NGOs (e.g., Pandu Laut).

- The Strategic Shift: Moving from “Passive Beneficiaries” to “Active Value Creators.”

- Detailed Function:

- The Energy Source: The daily labor of the fisher is the heartbeat of the model. Without their catch, there is no revenue to service loans or fund batteries. They are not just “users”; they are the engine.

- The Representative Interface (Koperasi): Individual fishers are often “unbankable” due to informal incomes. When aggregating them into Koperasi, the Social Element creates a legal entity capable of signing contracts, managing assets, and enforcing community accountability (gotong royong), as well as providing collateral guarantees and representing a huge basin of votes for politicians.

- Adoption & Trust: Transitioning from combustion to electric is a cultural leap. The Social Element provides the peer-to-peer validation required to overcome skepticism and get the “word of mouth” circulate.

- The Marketing Channel (Word-of-Mouth): Traditional B2C advertising fails in these close-knit communities. The Social Element acts as the exclusive marketing engine. Growth relies on “Viral Trust” propagated by “Pilot Captains”, respected elders whose success triggers a “Fear Of Missing Out” (FOMO) cascade among peers, overcoming deep-seated skepticism.

Helix 2: The Government Element (The Macro-Architect)

-

- Entities: Ministries (Maritime, Energy, Finance), State-owned Enterprises (PLN), and Regional Administrations.

- The Strategic Shift: Moving from “Subsidizer” to “Investor.”

- Detailed Function:

- Fiscal Reallocation: The government currently burns billions in fossil fuel subsidies. This model offers an exit strategy. Every electric boat deployed allows the state to reallocate subsidy funds toward infrastructure, education or to provide collateral guarantees.

- Risk Mitigation (Sovereign & Regulatory): By providing “First Loss” guarantees for green loans or subsidizing the initial battery infrastructure, the Government de-risks the entry for private banks.

- Blue Economy Policy: The government sets the “rules of the road”—standardizing charging protocols and granting concession rights for port electrification, effectively creating a protected market for clean energy.

- Basin of Votes: The Koperasi and the underlying communities, does not just represent a customer base; they represents a unified political bloc of roughly 10-12 million people (roughly 5-6% of the national electorate).

- Political Shield: No local regent (Bupati) or governor acts against a project that secures the economic welfare of such a decisive voting bloc. This lowers the Regulatory Risk for investors significantly.

Helix 3: The Finance Element (The Time-Bridge)

The Kredit Usaha Rakyat (KUR) Mandiri program for 2026, as an example, offers specialized financing for the fisheries sector, specifically designed to help fishermen and fish-farmer groups (Gapoktan) access low-interest capital for working needs or investments.

-

- Entities: Commercial Banks (KUR distributors), Impact Investors, Venture Capital, and Development Finance Institutions (DFIs).

- The Strategic Shift: Moving from “Collateral-Based Lending” to “Asset-Backed & Cash-Flow Lending.”

- Detailed Function:

- The CAPEX Bridge: The fundamental barrier is the upfront cost of Li-Ion batteries. The Finance Helix bridges this gap, allowing fishers to pay for the asset over time using the very savings the asset generates.

- Blended Finance: This helix combines concessional capital (philanthropic grants) to absorb initial risks with commercial capital (bank loans) to scale the solution.

- The Battery as Collateral: Instead of demanding land titles from poor fishers, the Finance Element accepts the smart, IoT-enabled battery as collateral. If payments stop, the asset can be digitally locked or retrieved, securing the loan.

Helix 4: The Academic Element (The Auditor & Optimizer)

-

- Entities: Universities, Marine Research Bodies, Data Science Institutes, and Think Tanks.

- The Strategic Shift: Moving from “Theoretical Research” to “Applied Verification.”

- Detailed Function:

- MRV (Measurement, Reporting, Verification): In the carbon market, trust is currency. Academia uses data from the boats to scientifically quantify CO2 reductions, turning emission savings into tradeable Carbon Credits.

- Socio-Economic Impact Validation: Investors demand proof of “Social Return on Investment” (SROI). Academia conducts longitudinal studies to prove that fisher incomes are actually rising, safeguarding against predatory practices.

- Technological Refinement: Continuous analysis of hull hydrodynamics and battery thermal performance ensures the Industry Element (GEMPACS) builds the most efficient machines possible for specific local waters.

Helix 5: The Industry Element (The Integrator – GEMPACS)

-

- Entities: GEMPACS, Tech Supply Chain, Boat Builders, and Maintenance Networks.

- The Strategic Shift: Moving from “Hardware Manufacturer” to “Marine Electrification Services Provider.”

- Detailed Function:

- System Integration: GEMPACS does not just sell a motor; it delivers a “Full Stack” solution—integrating propulsion, energy storage, and charging infrastructure into a seamless experience.

- Reliability Engineering: The “Social Engine” cannot stop. Industry guarantees 99% uptime through robust engineering and rapid-response maintenance networks.

- Digital Orchestration: Industry builds the software backbone that connects all helices—providing the dashboard where the Bank sees repayment, the Government sees carbon saved, and the Fisher sees low cost energy.

3. The Energy & Value Flow: A Systemic Cycle

The model operates on a circular flow of value, powered by the daily work of the Social Element.

The model operates on a circular flow of value, powered by the daily work of the Social Element.

-

- Capital Injection: The Finance Helix (backed by Government guarantees) injects capital into the Industry Helix (GEMPACS) to manufacture and deploy fleets.

- Kinetic Action: The Social Helix (Fisher) utilizes the technology. Instead of purchasing 20L of subsidized petrol (burning cash), they charge or swap a battery (using renewable energy).

- Value Capture: The fisher performs their work. The operational cost drops by ~70%. This “avoided cost” is the surplus value captured by the system.

- Distribution Waterfall:

- Tier 1 (Livelihood): A significant portion of the savings stays with the fisher, immediately raising their net income.

- Tier 2 (Service): A portion is automatically deducted to pay for the system lease fee (revenue for Industry).

- Tier 3 (Repayment): A portion services the principal and interest of the loan (return for Finance).

- Macro Validation: Academia verifies the data; Government logs the subsidy reduction and carbon reduction credits.

4. Achieving the Strategic Goals Trinity

5. Risk Matrix & Advanced Mitigation

| Friction Point | Responsible Helix | Advanced Mitigation Strategy |

| Technology Rejection | Social (User) | Influence Mapping: Deploying “Pilot Captains”—respected elders in the fishing community—as early adopters to leverage social hierarchy for trust building, through the “Word of Mouth” marketing. |

| Credit Default | Finance (Bank) | Tech-Enforced Collateral: The IoT system allows for remote disabling of the motor (“kill switch”) if lease payments are defaulted, turning the asset into a secured guarantee. |

| Grid Availability | Industry (Infra) | Captive Charging: Fishing boats form a ‘captive’ fleet, concentrated exclusively at ports (pelabuhan) and beaches (pantai) rather than dispersed locations. By using solar canopies to lower energy demand and reduce queuing, constant station utilization and steady, predictable revenue are guaranteed. |

| Regulatory Flux | Government | Policy Lock-in: Academia publishes white papers proving the “Cost of Inaction,” making it political suicide to reverse supportive policies once the economic benefits (jobs, GDP) are realized. |

| Data Credibility Gap | Academia | Automated MRV: Implementing sensor-to-blockchain pipelines to replace manual audits, ensuring carbon credit verification is real-time, transparent, and tamper-proof. |

5.1 Operational De-Risking: The Solar-Schedule Synergy

One of the primary risks in rural electrification is infrastructure reliability. GEMPACS minimizes this risk not just through hardware, but by aligning the technology with the natural “pulse” of the fishery.

-

- Decentralized Resilience (Solar Canopies): Traditional Indonesian boats (jukung) have long arms (outriggers) on the sides to keep them steady. These arms make the boat very wide. This allows Gempacs to install a massive solar canopy (up to 3 kW), light in weight, on a relatively small boat.

Thus, the boat makes its own fuel from the sun while it fishes. This saves money and puts less strain on the electrical grid, making the gempacs solution somehow independent from it.

- The “Relaxed Schedule” Advantage: unlike urban logistics which demand instant uptime, artisanal fishing has natural pauses defined by nature.

- Weather Buffers: High waves or storms often ground fleets for days. These “non-productive” days become valuable “energy harvesting” windows, allowing storage banks to fully recharge via solar without grid stress.

- Daylight Sync: Many fishers operate nocturnally (using lights to attract fish) and dock during the day. This creates a perfect synchronization with peak solar generation, allowing direct sun-to-battery charging.

- Strategic Outcome: This alignment allows the use of slow charging protocols rather than expensive, grid-heavy fast chargers. This significantly extends battery cycle life (reducing long-term CAPEX) and lowers the barrier to entry for infrastructure setup.

- Decentralized Resilience (Solar Canopies): Traditional Indonesian boats (jukung) have long arms (outriggers) on the sides to keep them steady. These arms make the boat very wide. This allows Gempacs to install a massive solar canopy (up to 3 kW), light in weight, on a relatively small boat.

6. Investment Thesis: The Case for Impact Capital

For Impact Investors seeking to maximize the “Triple P Bottom Line” (People, Planet, Profit), the GEMPACS Quintuple Helix offers a uniquely robust value proposition. It resolves the common dilemma of “High Impact vs. Low Returns” by structuring the ecosystem to be commercially viable through systemic efficiency.

6.1 The “Triple Return” & “Six SDGs” Profile

-

- Financial Return (Profit): unlike purely philanthropic projects, this model generates recurring, predictable cash flows. The demand for energy (battery swapping) is inelastic—fishermen must go to sea to eat. This creates a utility-like revenue stream that is stable and scalable, offering competitive IRRs (Internal Rate of Return), yet providing affordable and clean energy with ease, fulfilling SDG 7 and improve the Infrastructure SDG 9.

- Social Return (People): The impact is direct and verifiable. Investors tackle SDG 1 (No Poverty) and SDG 8 (Decent Work). By cutting fuel costs by ~70%, the net income of the “Base of the Pyramid” demographic increases immediately. This is not a “trickle-down” effect; it is a direct “bottom-up” wealth injection.

- Environmental Return (Planet): The investment directly abates carbon emissions (SDG 13) and prevents marine oil spills and noise pollution SDG 14. Every dollar invested correlates directly to liters of fossil fuel displaced.

The United Nations Sustainable Development Goals (SDGs), or the 2030 Agenda, are 17 interlinked global goals adopted by all Member States in 2015. They serve as a comprehensive blueprint for a more sustainable future by addressing critical challenges such as poverty, inequality, climate change, and environmental degradation.

The United Nations Sustainable Development Goals (SDGs), or the 2030 Agenda, are 17 interlinked global goals adopted by all Member States in 2015. They serve as a comprehensive blueprint for a more sustainable future by addressing critical challenges such as poverty, inequality, climate change, and environmental degradation.

This model impacts directly and consistently on 6 of the United Nations Sustainable Development Goals

6.2 Structural De-Risking (Blended Finance)

The Quintuple Helix structure significantly lowers the risk profile for private capital compared to a standalone startup investment:

-

- Government-Backed Floor: With the Government Helix providing “First Loss” guarantees or subsidized micro-credit (KUR), the downside risk for commercial investors is capped.

- Asset-Backed Security: The investment is not just in “operations” but in physical, IoT-traceable assets (batteries). In a worst-case scenario, the high-value battery packs can be recovered and repurposed (e.g., for stationary storage), preserving principal capital.

6.3 The “Blue Carbon” Upside

Beyond the interest or equity returns, the involvement of the Academic Helix unlocks a secondary revenue stream: Carbon Credits. Because the emission reductions are scientifically verified and digitally tracked in real-time, the project creates high-quality, auditable blue carbon assets. This provides an “equity kicker” for investors, potentially boosting returns significantly as global carbon prices rise.

7. Conclusion: The Symphony of Progress

The GEMPACS Quintuple Helix transforms the business landscape from a series of disconnected transactions into a National Economic Engine.

The GEMPACS Quintuple Helix transforms the business landscape from a series of disconnected transactions into a National Economic Engine.

It acknowledges a fundamental truth: Technology alone cannot solve poverty. A motor is useless without the capital to buy it, the laws to govern it, the data to prove it works, and the people to use it.

By orchestrating these five elements, GEMPACS creates a resilient structure where the success of one Helix means the success of all. The Fisher earns more, the Bank gets repaid, the Industry grows, the Academy learns, and the Government saves. It is a symphony of progress, powered by the tides and the people who sail them.